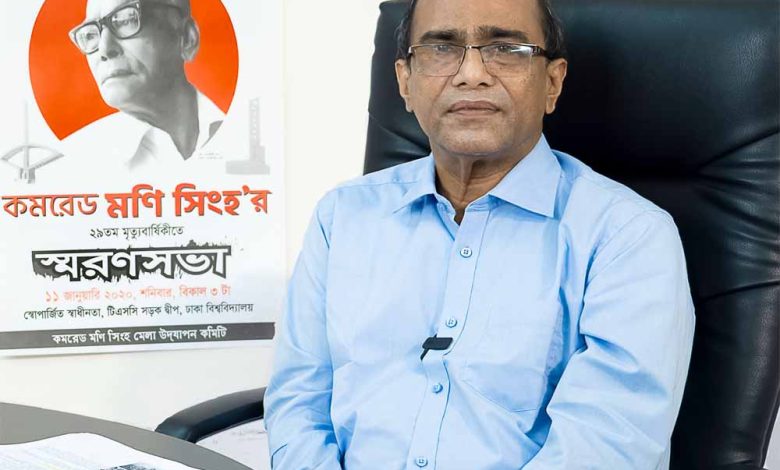

Dibalok Singha on microfinance in Bangladesh: Triumphs, challenges, and the urgent need for reform

Holiday Post Report: In a wide-ranging discussion with Holiday Post, Dibalok Singha, Executive Director of DSK, laid bare both the extraordinary achievements and pressing challenges facing Bangladesh’s microfinance sector. With decades of experience shaping financial inclusion efforts, Singha offered a clear-eyed assessment: while Bangladesh remains a global leader in poverty alleviation through microcredit, the sector now stands at a critical juncture requiring bold reforms and innovative thinking.

The successes are undeniable. Institutions like Grameen Bank and BRAC have demonstrated how microfinance can empower women, boost rural economies, and bring financial services to previously excluded populations. “We’ve created a model that the world studies,” Singha noted with pride. Yet this very success, he argued, has bred complacency at a time when the sector faces unprecedented challenges. Over-indebtedness, climate vulnerabilities, and rigid regulations threaten to undermine decades of progress.

Government policies receive mixed marks in Singha’s assessment. While acknowledging the Microcredit Regulatory Authority’s role in ensuring transparency, he criticized blunt policy instruments like uniform interest rate caps that fail to account for regional disparities in operational costs. “Regulation should enable growth, not strangle it,” he asserted, calling for tiered approaches that distinguish between large institutions and smaller MFIs serving hard-to-reach communities. Bureaucratic delays in approving new products and services similarly hamper the sector’s ability to innovate and respond to client needs.

Technology dominates Singha’s vision for the future. “Digital transformation isn’t coming—it’s already here,” he stated, urging rapid adoption of mobile banking, AI-driven credit scoring, and blockchain solutions. However, he cautioned that technological advancement must not leave vulnerable groups behind, advocating for hybrid models that maintain human touch points alongside digital services.

The climate crisis features prominently in Singha’s reform agenda. With Bangladesh on the frontlines of climate change, he called for green microfinance products—from solar energy loans to climate-resilient crop financing—that help communities adapt while creating new business opportunities for MFIs.

Perhaps most striking is Singha’s critique of traditional microfinance models in addressing youth unemployment and urbanization. “The next generation doesn’t want the same small group loans that worked for their parents,” he observed, pushing for startup capital, digital skills training, and connections to e-commerce platforms that meet young entrepreneurs’ aspirations.

Drawing on 35 years of experience, Singha offered both warning and opportunity. “We can either rest on our laurels while the world moves forward, or we can lead the next revolution in financial inclusion.” His message was clear: the time for incremental change has passed. Bangladesh’s microfinance sector must embrace innovation, adapt to climate realities, and rethink outdated models if it hopes to maintain its hard-won position as a global leader in poverty alleviation.